|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Car Insurance Engine Size: Coverage Guide for U.S. ConsumersWhen considering car insurance, engine size can play a significant role in determining your coverage options and costs. This guide will help you navigate the complexities and make informed decisions about protecting your vehicle, managing repair costs, and understanding extended auto warranties. Understanding the Impact of Engine SizeEngine size is often a factor in insurance premiums because it can influence a car's performance, speed, and potential repair costs. Larger engines typically mean higher premiums, but let's delve deeper into why this is the case. Performance and RiskVehicles with larger engines are generally capable of higher speeds, which can increase the likelihood of accidents. Insurers consider these factors when calculating your premium, as higher speeds can lead to more severe damage. Repair CostsRepairing a car with a larger engine can be more expensive. The parts may be costlier, and the labor more intensive, which can drive up the overall repair bill. Insurance companies factor this into your policy cost to ensure they can cover potential claims. Benefits of Insuring Based on Engine SizeWhile larger engine vehicles may have higher premiums, there are notable benefits to understanding and choosing the right insurance policy.

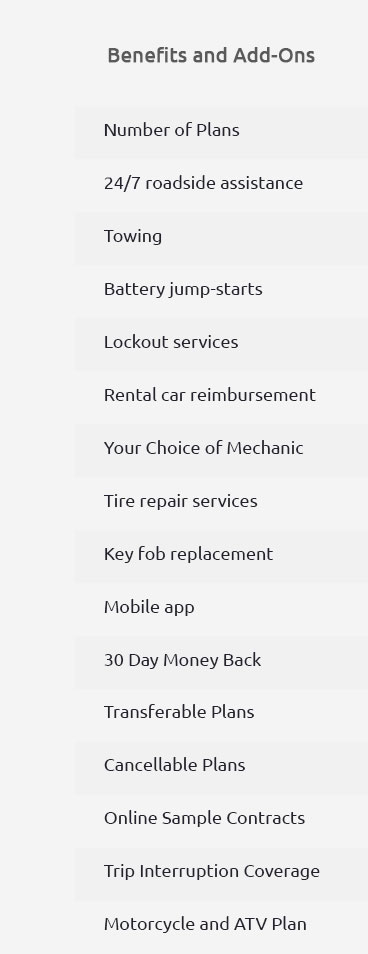

For more on what is covered, consider exploring car liability coverage, which provides details on protection against damages to other parties. Extended Auto WarrantiesExtended warranties offer an additional layer of protection, especially valuable for high-performance engines. These warranties can cover a wide range of components, which might otherwise be expensive to repair. What’s Covered?An extended warranty often covers significant engine parts, electrical systems, and more. It's crucial to understand the specifics of what is included to ensure your vehicle is adequately protected. Choosing the Right WarrantyConsider your vehicle's engine size and potential repair costs when selecting an extended warranty. This tailored approach can maximize your benefits and savings. Additionally, understanding about gap insurance can help cover the difference between the car's value and what you owe on it, providing another layer of financial security. FAQs About Car Insurance and Engine Size

https://www.cuvva.com/how-insurance-works/engine-size-and-insurance-price

As a general rule of thumb, the bigger your car's engine is, the more expensive it is to insure. https://wallethub.com/answers/ci/does-engine-size-affect-insurance-1000155-2140758734/

Yes, engine size affects insurance because insurers take specific vehicle details into account when determining car insurance prices. https://www.quora.com/Does-a-car-engine-size-affect-insurance

Hi, that's a very relevant question. And to answer it, yes, the motor size definitely affects the insurance cost. Motor size usually refers to ...

|